Governance

Accelerate understands that good governance is about making the right decisions for the business and its various stakeholders. To flourish, an organisation needs a corporate governance framework that guides its business and reassures stakeholders that the correct checks and balances cement ethical conduct.

Accelerate Property Fund started as a private venture and became a listed company during December 2013. From the outset, the business’s governance structures and practices were rigorous and designed to instil confidence by creating and protecting stakeholder value.

Accelerate Property Fund started as a private venture and became a listed company during December 2013. From the outset, the business’s governance structures and practices were rigorous and designed to instil confidence by creating and protecting stakeholder value.

It is important to understand that creating transparent and effective governance in the organisation is not a once-off exercise. It requires an ongoing review of existing processes and practices against board and company objectives, while demanding that an organisation adapt and adjust to the external operating context and evolving best practice.

Implementing the King Code of Corporate Governance for South Africa, 2016 (King IV) within the business has offered us an opportunity to revisit our governance framework. Through this process, our commitment to creating fit-for-purpose governance structures that adhere to the highest standards has once again been affirmed and entrenched throughout the organisation.

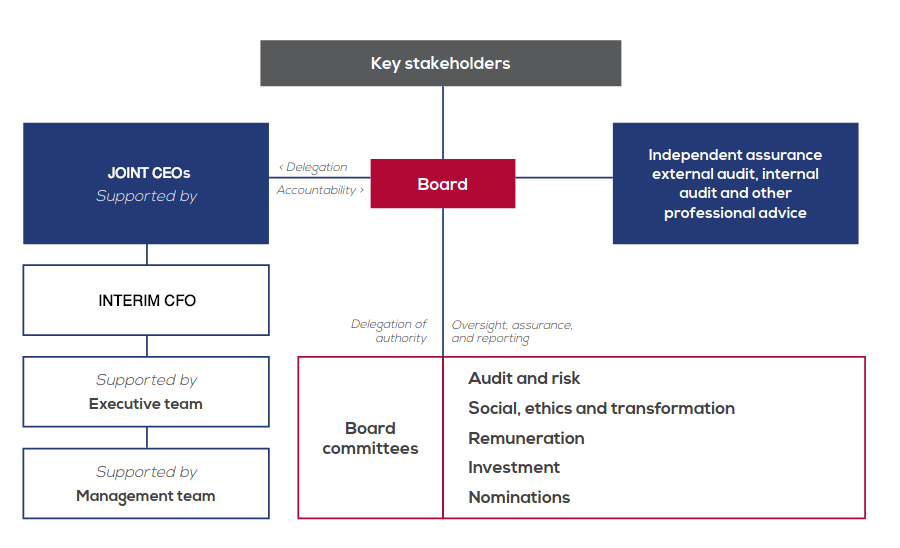

The board of directors is responsible for the overall direction and supervision of the company, with general management delegated to the executive members. The executives and certain senior management are responsible for the asset management function, which in turn directs the property management function.

Company structure

Independent Director and Chairman

Tito Mboweni

Investment committee

Derick van der Merwe

Audit and Risk Committee

Derick van der Merwe

Joint Chief executive officers

Dawid Wandrag

Abri Schneider

Social, Ethics and Transformation committee

Kolosa Madikizela

Remuneration committee

Abel Mawela

Nominations Committee

Tito Mboweni

Interim Chief financial officer

Pieter Grobler

Asset management

Leon Louw

Company secretary

Margi Pinto

Investor relations

Articulate Capital Partners

Internal audit

LM consulting

Executive Directors

Mr Dawid Wandrag

Joint Chief Executive Officer

BCom (Accounting)

Appointed 1 May 2019

Mr Wandrag retired after a 35-year career in the South African banking sector, and was part of the team tasked with establishing RMB Private Bank. Mr Wandrag also held leadership positions in many of South Africa’s leading financial institutions during his career.

His special interest in real estate, new developments and redevelopments saw him gain experience in financial modelling and analysis, development and construction, funding and debt structures. Leadership roles include Head of Credit Risk, Valuations, Legal Risk and Recoveries at Rand Merchant Bank, Chairman of the Group Wealth Committee, and the Group Property Finance Credit Committee at the Firstrand Group, among others.

Mr Abri Schneider

Joint Chief Executive Officer

CA(SA), BCom LLB

Appointed: 23 March 2023

Mr Schneider worked at the IDC, Gensec Bank and the FirstRand Group, where he headed up FNB Corporate Property Finance. He spent the last 15 years building various businesses in the Storage and Serviced Office Industries, with a particular focus on flexible space offerings.

Independent directors

Mr Tito Mboweni

Independent director and chairman

BA, MA

Appointed: 1 February 2022

Mr Mboweni has diverse experience, having served in the South African Government as the Minister of Finance and Governor of the South African Reserve Bank. Mr Mboweni is an international advisor to Goldman Sachs International. He is a non-executive director of Discovery Ltd and non-executive deputy chairman of South Africa Zijin Platinum (Pty) Ltd. Mr Mboweni is the chairman of the Board of the African Centre for Economic Transformation and a trustee of the African Union Peace Fund. He is also a member of the Council of Advisors of the Thabo Mbeki Foundation and holds a number of honorary qualifications and academic positions.

Mr Derick van der Merwe

Lead independent director

BCompt (Hons), CA(SA), ACIOB

Appointed 1 February 2021

Mr van der Merwe is an associate member of the Chartered Institute of Building, and past president of the South African Chapter of FIABCI (the International Real Estate Federation). Derick had a 28‑year career in property, which included managing the planning and development of the V&A Waterfront, and holding various executive roles culminating in Chief Executive Officer of the V&A Waterfront. Derick has continued consulting to the property industry since 2008, both locally and internationally, and has extensive experience serving on boards, audit and risk committees and finance committees.

Dr Kolosa Madikizela

Independent director

Doctor of Philosophy (PhD) Construction Economics and Management

Appointed: 1 June 2013

Dr Madikizela has recently successfully completed a PhD in Construction Economics and Management from the University of Cape Town. Dr Madikizela was most recently the Managing Director at Pragma Africa, an engineering organisation specialising in physical asset management. Dr Madikizela’s 17–year career spans across the Construction, Property Development and Engineering sectors where she has occupied Senior Management, Executive Management and CEO level positions at various multinational organisations, including Pragma Global, Aurecon Group, Shell SA, The Life Healthcare Group, The Aveng Group and Nexus Facilities Management Company.

Mr Abel Mawela

Independent director

BCom (Hons), MBA

Appointed 1 May 2019

Mr Mawela is the Managing Director of Molodi Consulting Services, and has held various leadership and financial oversight roles in private and public sector organisations. A member of the Chartered Institute of Government Finance, Audit and Risk Officers and the Institute of Directors of Southern Africa, Mr Mawela has extensive experience in corporate governance, including board memberships and audit, risk and finance committee roles in organisations as diverse as the Export Credit Insurance Corporation (ECIC), the Gautrain Management Agency (GMA), the Automotive Industry Development Corporation (AIDC) and The South African Board for Sheriffs, among others.

Non-executive directors

Mr Michael Georgiou

Non-Executive Directors

Appointed: 1 January 2013

Mr Georgiou owns one of the largest private property portfolios in South Africa. In a property career spanning 20 years, he has successfully acquired and/or developed over 100 properties, including prominent properties such as Fourways Mall Shopping Centre; Cedar Square, Fourways (award-nominated); Loch Logan Waterfront Shopping Centre, Bloemfontein (award-nominated); Windmill Casino Hotel and Retail Complex; the Fort Drury Complex and Sediba Building for Department of Public Works; and College Acre Development for Liberty Holdings Ltd and First National Bank, a division of the FirstRand Group. Mr Georgiou has a wealth of property knowledge and is respected as a market leader by his peers in the property industry.

Mr James Templeton

Non-executive director

Bcom (Hons), CFA

Appointed: 1 February 2022

Mr Templeton is the Chief Executive Officer of Castleview Property Fund Ltd (appointed on 6 July 2017), and was the Chief Executive Officer of Emira Property Fund Ltd from 2004 to 2015. Mr Templeton was an Equities Analyst at Barnard Jacobs Mellet from 1996 to 2003 where he covered various sectors including real estate, construction and diversified industrial holdings.

As a company, we aim to make a difference in our local communities. Accelerate supports a wide variety of charity focused outreach initiatives. Our centres help to raise awareness and funds for worthy causes and facilitate donations of food, clothing, school bags, library books, stationery and sports kits, and activities for the young and old.

We at APF do our part to protect the environment and the well-being of our employees, tenants, customers, and service providers. We continue to implement a range of environmental and health and safety initiatives at our properties.

APF provides resources, both financial and non-financial, to educational initiatives with the aim of stimulating and supporting social economic upliftment in these areas. In keeping with this focus, Accelerate has partnered with P&D Outreach centre with the aim of establishing a supportive relationship and upgrading infrastructure so that learners can focus on their academic careers.

Social Investment And Philanthropic Areas Unpacked

Employees

We aim to make a difference in the lives of employees and their families, providing them with income, educational opportunities and skills development. We believe that employees are core to our success, and that providing an environment in which they can reach their full potential benefits them and the company.

Education

Accelerate recognises that an investment in education is an investment in the future of South Africa, one that yields sustainable returns and has the potential to create meaningful value for generations to come. Our aim is to build sustainable relationships with education facilities in the areas in which we operate, and work to help them provide top‑quality education.

Social development

Accelerate believes that investment into social entrepreneurship, particularly among women and youth, has far‑reaching benefits for the country, the communities in which we operate, and the company itself. We aim to uplift individuals who have the potential and the desire to make a difference in their own environment. We do this through job creation, training programmes, and skills development within local communities.

Environment

With the construction and on-going operation of buildings consuming 40% of total energy usage worldwide and generating a third of all carbon emissions. Accelerate acknowledges that it has a major role to play to addressing climate change and resource scarcity. APF is making concerted steps to reduce our carbon footprint over time.